A Beginner's Guide to Bull Markets: Investing Tips and Tricks

Nov 23, 2023 By Triston Martin

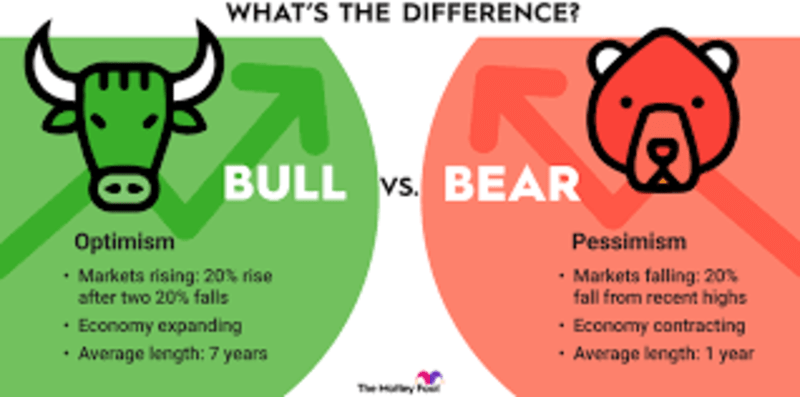

In the dynamic world of finance, understanding the intricacies of bull markets is crucial for any investor seeking to navigate the often unpredictable terrain of the stock market. A bull market, characterized by rising asset prices and investor optimism, can present lucrative opportunities for those who know how to harness its potential. This comprehensive guide aims to demystify bull markets, providing both novice and experienced investors with valuable insights and strategies to make informed decisions during these bullish phases.

Understanding Bull Markets:

A bull market is generally defined as a sustained period of rising asset prices, typically associated with a positive economic outlook. During these periods, investor confidence is high, leading to increased buying activity. It's important to note that bull markets can apply to various asset classes, including stocks, bonds, and commodities.

Key Characteristics of Bull Markets:

- Rising Asset Prices: Bull markets are marked by a consistent uptrend in asset prices. This upward movement is often fueled by positive economic indicators, such as robust GDP growth, low unemployment rates, and increased consumer spending.

- Optimistic Investor Sentiment: Investor confidence plays a pivotal role in sustaining a bull market. Positive news about economic performance and corporate earnings can create a sense of optimism among investors, encouraging them to buy and hold assets.

- Low Volatility: Bull markets typically experience lower levels of market volatility. As prices steadily rise, the market becomes less prone to sudden and drastic fluctuations, providing a more stable environment for investors.

Navigating Bull Markets Effectively:

- Diversification:Diversifying your investment portfolio is a fundamental strategy during bull markets. While certain sectors may experience rapid growth, it's crucial to spread your investments across various asset classes to mitigate risk.

- Stay Informed:Keeping abreast of economic indicators, corporate earnings reports, and global events is essential. This knowledge equips investors to make informed decisions based on the current economic climate and anticipate potential market shifts.

- Long-Term Perspective:Successful investors in bull markets often adopt a long-term perspective. Instead of attempting to time the market, focus on the fundamentals of your investments and their growth potential over an extended period.

- Risk Management:Even in a bull market, there are inherent risks. Implementing risk management strategies, such as setting stop-loss orders and periodically rebalancing your portfolio, helps protect against potential downturns.

The Psychology of Bull Markets: Emotions and Decision-Making:

One aspect often overlooked in discussions about bull markets is the psychological component. Understanding the emotions that drive market participants during these periods is crucial for making rational decisions. In bull markets, the prevailing optimism can lead to a phenomenon known as "FOMO" (Fear of Missing Out). Investors may be tempted to chase returns and make impulsive decisions. It's essential to stay disciplined, avoid succumbing to emotions, and base investment choices on thorough research and a well-defined strategy.

Understanding Investor Sentiment in Bull Markets:

- Greed: Greed is a prevalent emotion during bull markets, as investors experience the excitement of seeing their investments grow significantly. While some level of risk-taking may be necessary to capitalize on opportunities, it's crucial to temper greed and maintain a rational approach.

- Overconfidence: In an environment of rising prices, investors may become overconfident in their abilities to navigate the market successfully. This can lead to excessive risk-taking and ignoring warning signs of a potential downturn.

- Fear: Despite overall optimism, fear can creep in during bull markets. Investors may worry that they are missing out on even bigger gains or become anxious about the potential for a sudden market crash. It's essential to stay level-headed and stick to your investment plan amidst these emotions.

Emotional Discipline: The Key to Rational Decision-Making:

In bull markets, emotions can play a significant role in investment decision-making. It's crucial to maintain emotional discipline and avoid making impulsive decisions based on fear or greed. Strategies such as diversification, setting clear goals and risk management techniques can help investors stay grounded and make rational choices.

Psychological Biases and Their Impact on Investment Choices:

- Confirmation Bias: This bias occurs when investors seek out information that supports their existing beliefs and ignore contradictory evidence. In bull markets, this can lead to holding onto underperforming assets in the hopes of a rebound.

- Herd Mentality: Investors may feel pressure to follow the crowd during bull markets, leading to "groupthink" and potential overvaluing of certain assets. Staying informed and making independent decisions can help avoid this bias.

- Loss Aversion: The fear of losing money often leads investors to hold onto poorly performing assets in the hopes of breaking even. This emotional attachment can cloud rational decision-making, leading to missed opportunities for profitable investments.

Strategic Emotional Management in Bull Markets:

Managing the psychological aspect of investing in bull markets requires a strategic approach. Some ways to overcome emotional biases and make rational decisions are:

- Set Clear Goals: Define your investment objectives and stick to them, regardless of market sentiment.

- Do Your Research: Stay informed about market trends, economic indicators, and individual assets before making any investment choices.

- Stay Disciplined: Create an investment plan and stick to it, resisting the urge to make impulsive decisions based on emotions.

- Consult with a Financial Advisor: Seeking professional guidance can provide valuable insights and help balance out emotional biases.

Identifying Opportunities in Bull Markets

While a rising tide may lift all boats in a bull market, astute investors know that not all assets perform equally. Identifying sectors or industries with strong growth potential can be a key driver of success. Technological advancements, emerging markets, and innovative industries often flourish during bullish phases. Conducting thorough fundamental analysis and staying attuned to market trends can help investors pinpoint promising opportunities for long-term growth.

Strategies for Different Investment Vehicles:

Depending on your risk tolerance, investment horizon, and financial goals, different strategies may be suitable for navigating bull markets:

- Stock Market Investments:In a bull market, individual stocks can experience substantial gains. Consider focusing on companies with strong fundamentals, sound management, and a competitive edge. Dividend-paying stocks can provide a steady income stream, adding stability to your portfolio.

- Bonds and Fixed-Income Securities:While stocks often take the spotlight during bull markets, fixed-income securities should not be overlooked. Diversifying your portfolio with high-quality bonds can provide stability and income, particularly in the face of market volatility.

- Real Estate Investments:Real estate can be a resilient asset class in bull markets. Commercial and residential properties may see increased demand, leading to potential appreciation. Real estate investment trusts (REITs) offer a way to gain exposure to the real estate market without directly owning properties.

- Commodities and Precious Metals:Bull markets can drive demand for commodities such as gold and silver. These assets are often viewed as safe havens during times of economic uncertainty. Including a portion of precious metals in your portfolio can act as a hedge against inflation and currency fluctuations.

Conclusion:

Demystifying bull markets is a critical step for investors looking to capitalize on the opportunities presented during these optimistic phases. By understanding the key characteristics of bull markets and employing effective investment strategies, individuals can navigate the complexities of the financial markets with confidence. Remember, successful investing involves a combination of knowledge, discipline, and a well-thought-out approach to risk management. As you embark on your investment journey, use this comprehensive guide to empower yourself with the tools needed to thrive in the exciting world of bull markets.