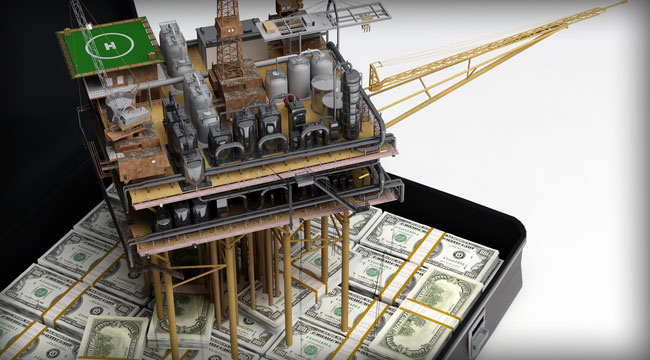

How Petrodollars Affect the U.S. Dollar: Everything You Need To Know

Aug 17, 2022 By Susan Kelly

Petrodollars are not a currency; they are just U.S. dollars that were traded for exports of crude oil. In the middle of the 1970s, when the U.S. and crude oil exporters became more dependent on each other, this term came to be used extensively in business and politics. The fact that foreign oil exporters used the U.S. dollar as their primary currency and place to store value showed that the dollar was already the world's reserve currency, a position it still holds without serious competition. Because the U.S. economy is the world's largest and most open to trade and investment from other countries, the dollar is well known and used worldwide. Oil exporters couldn't pass up these benefits, and their reliance on the dollar made it even stronger.

The Petrodollar's Rise

The world economy and the need for stable assets expanded at a quicker pace than the availability of bullion, which led to the collapse of the Bretton Woods system in 1971, which had fixed exchange rates for currencies connected to gold via the US dollar. Just the dollar has the potential to fill that hole. Because of the United States' trade and fiscal imbalances, the number of petrodollars received by oil-exporting countries from dramatically higher crude oil prices increased.

Exporters had no choice but to accept dollars because that was the currency of their biggest customer and, more importantly, the currency of international trade and finance. Deals were struck between the United States and KSA to establish the terms under which Saudi petrodollars may be re-invested in the United States—beginning in the late 1970s with the discovery of gas and oil reserves outside of the Middle East. Petrodollars soon found their way to fresh exporters such as Norway, whose sovereign wealth funds were valued at $1.4 trillion by the end of 2021 and controlled roughly 1.5% of all publicly listed world equities.

Petrodollar Recycling Profits

The most important thing that happened when petrodollars were re-invested in the U.S. and other countries was that business could go on as usual. Foreign oil exporters could keep sending crude and getting paid in the most helpful currency while the U.S. kept its economic, financial, technological, and military leaders. Because of the rise of the petrodollar, the U.S. had to give up some of its political and economic power to the developing countries that gave it energy. Along with development projects and cross-border investment flows, the petrodollar paid for U.S. arms exports, which sped up the arms race in the Middle East. The petrodollar made the dollar even more critical worldwide by increasing the demand for dollar investments outside the U.S., including in the growing eurodollar market.

Doomsday Forecasting Vs. Reality

There is a natural tension between the global demand for assets that can be invested and are denominated in a widely used currency and the likelihood that issuing a lot of these liabilities over time will hurt the issuer's creditworthiness and make people less confident in its currency. The economist Robert Triffin first explained this problem in 1960. It is now called the Triffin Dilemma. In practice, users get the benefits of a dominant reserve currency right away, while the problem Triffin pointed out happens slowly and at an unknown time. As late as 1968, nearly a century after the U.S. passed the U.K. as the world's largest economy, 30% of all foreign exchange reserves were in British pounds.

As of 2020, the U.S. economy still made up almost a quarter of the world's GDP and was more than 40% bigger than its closest competitor. It also had the biggest current account deficit in the world. Triffin pointed out that a country with a reserve currency can't avoid having a significant current account deficit. The world's economies keep changing in ways that make the system less stressed. For example, the U.S. has become a net exporter of oil and oil products in recent years. Oil-producing states like Texas get more regular dollars and fewer "petrodollars."

Conclusion

The ascendance of petrodollar oil export revenues mirrored and further solidified the U.S. dollar's position as the preeminent trading and investment currency across the world. The dependence of the American economy on oil imports and petrodollar reinvestment has decreased significantly due to significant increases in the country's domestic energy supply. As a reserve currency, the United States dollar continues to have a significant influence on the economy of the whole world.